Over the years Indian importers have used Suppliers Credit and Buyers Credit as two different modes of Import financing. RBI had defined them as Trade Credit under Master Direction for ECB and Trade Credit.

Suppliers Credit structure was understood as financing of import usance Letter of Credit (LC) by Overseas branches / Foreign banks where as Buyers Credit was considered as financing against LOU/LOC till it was stopped by RBI.

Continue reading What can be termed as Suppliers Credit? →

20.593684

78.962880

Below given are RBI FAQs on Trade Credit updated as on 26- Dec-2018. RBI has issued revised guidelines under” Trade Credit : New Regulatory Framework“. Will update this article as when RBI updates the FAQs with revised guidelines.

Continue reading RBI FAQs on Trade Credit : Updated as on 26 Dec 2018 →

As discussed in the earlier article, RBI issued a circular related to Trade Credit – New Regulatory Framework which has provided clarity on many aspects of Trade credit (Buyers Credit / Suppliers Credit). One of this aspect is All-in-Cost Ceiling.

This article is about All-in-Cost definition, relevant extracts of RBI circular, what has changed and what will be its impact on trade credit products offered by banks.

Continue reading Trade Credit : Changes in All-in-Cost Ceiling →

As discussed in earlier article, RBI issued a circular related to Trade Credit – New Regulatory Framework which has provided clarity on many aspects of Trade credit. One of the aspect is Trade Credit (Buyers Credit / Suppliers Credit) availed by units based in SEZ/FTWZ/DTA.

In this article we have provided relevant extracts related to SEZ/FTWZ/DTA, definition, documentation and process to be followed by developers and units.

Continue reading Can SEZ, FTWZ and DTA units avail Buyers Credit ? →

RBI has issued a new regulatory framework for Trade Credit (TC) on March 13, 2019 effective immediately. Details of the circular is given below. In next articles we will cover the major changes in the RBI circular.

Continue reading RBI Circular : Trade Credit – New Regulatory Framework →

In the earlier articles, we have discussed about LC format MT700, and how to prepare and check documents under LC. This article provides a checklist for exporter after Letter of Credit (LC) is opened before shipment of goods. This will help exporter better understand the details in LC and whether exporter will be able to comply with its terms. If not, exporter should ask to get amendment in relevant clause.

Continue reading How to Check if Letter of Credit is Workable →

New Article: RBI Circular: Trade Credit : New Regulatory Framework

RBI revised Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 on December 17, 2018 (link in reference). Revision is made to ECB guidelines, Trade Credit, borrowing by banks outside India and others.

This articles covers changes made to Trade Credit guidelines.

Continue reading Revised Guidelines for Trade Credit →

20.593684

78.962880

Post RBI disallowed LOU and LOC for buyers credit transactions, importers and banks are trying different structures which can assist in Import finance. Some of these structures are

- Suppliers Credit

- Buyers Credit Against SBLC (Standby Letter of Credit)

- Reimbursement Finance (Usance LC Reimbursement at Sight)

Continue reading Reimbursement Finance (Usance LC Reimbursement at Sight) →

Purpose of Letter of credit (“LC”) is to give payment security to the beneficiary subject to documents presented under the LC complying with the requirements of the LC.

To check if documents are compliant, banks examine the required documents based on:

- The terms and conditions of the documentary credit.

- The applicable rules of UCP 600.

- The applicable content of ISBP 745.

Continue reading How to Prepare and Check Letter of Credit Documents →

Documents under Documentary Credit (letter of credit) are broadly classified into four categories namely

Continue reading Documents Under Letter of Credit →

Since RBI Stopped Buyers Credit Transactions against LOU and LOC, few questions kept on coming up regularly

- What was the outstanding amount of buyers credit in overseas branches of Indian Bank as RBI data did not provide bifurcation products wise ?

- What is the run down in books of these bank since 13 March 2018 RBI Circular ?

- What is its impact on Libor based finance available to Indian importers ?

In this article we have provided the data and analysis which will answer the first two questions.

Continue reading Buyers Credit Outstanding Down by $25 Billion →

New Article: What can be termed as Suppliers Credit?

Supplier’s Credit is a structure of financing Import into India. In this structure, overseas suppliers or financial institutions outside India provide financing to importer on Libor linked rates against Usance letter of credit (LC). Supplier’s credit internationally is also known as Usance Payable at Sight (UPAS) structure.

Continue reading Letter of Credit Clauses Related to Suppliers Credit →

Earlier article “Types of Swift Message used in Letter of Credit and Suppliers Credit” discussed details related to Category 7 message. This article further explore MT700 used for Letter of Credit Issuance. This will help importers understand various fields in MT700, related UCP 600 reference etc.

Continue reading Letter of Credit – MT 700 Format →

20.593684

78.962880

SWIFT system is used for Bank to Bank communication and Bank to Corporate communication. There are different type of Swift messages format related to specific purpose. This article focuses on Category 7 message.

Continue reading Types of SWIFT Message used in Letter of Credit and Suppliers Credit →

New Article: What can be termed as Suppliers Credit?

Supplier’s Credit is a structure of financing Import into India. In this structure, overseas suppliers or financial institutions outside India provide financing to importer on Libor linked rates against Usance letter of credit (LC). Importer and Overseas Bank will have to follow below process

Continue reading Suppliers Credit Process Flow →

Continue reading Suppliers Credit Process Flow →

RBI issued a circular on 10 Sep 2015, revising the policy on Trade Credit (Buyers Credit & Suppliers Credit). Summary of the same is given below:

As per revised guidelines, RBI has allowed resident importer to raise trade credit in Rupees (INR) within below framework after entering into a loan agreement with the overseas lender:

Continue reading Buyers Credit & Suppliers Credit in Rupee (INR) →

The trigger for this topic is a question that a reader asked:

We have a processing facility of granite. Can we use buyers credit for consumables (our banker refusing for consumables). As per them only raw material is allowed for buyer credit

Continue reading Buyers Credit on Import of Non Capital Goods →

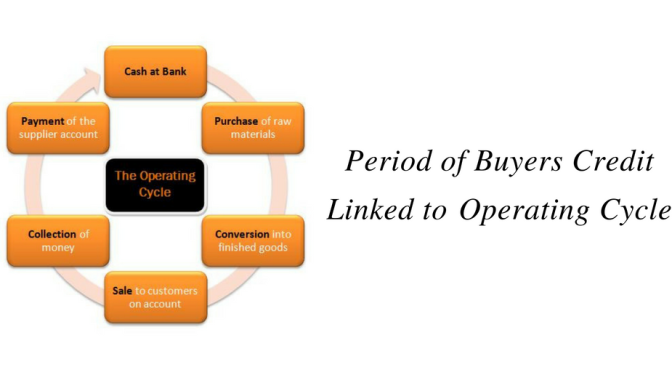

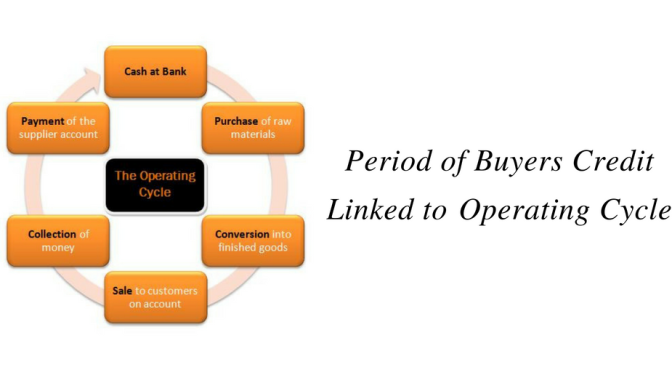

Incase of raw material imports, RBI had delegated approving powers to Authorised Dealers (Banks) for Trade Credit (Buyers Credit / Suppliers Credit) for a tenure upto 1 year from the date of shipment. Bank’s based on internal policies decided customerwise tenure. Because of variation in policies between banks, few importers used buyers credit for arbitrage.

Continue reading Relevance of Operating Cycle in Buyers Credit Transaction →

20.593684

78.962880

Further to article published below, RBI received suggestion from merchanting traders and trade bodies, based on which guidelines on merchanting trade transactions have been further reviewed on 28th March 2014 and with effect from 17th January 2014. Summary of the changes are given below.

Continue reading Revised Guidelines for Merchanting / Intermediary Trade →

18.436385

82.738182

The trigger for this topic is a question that a reader asked:

Question : What are the RBI guidelines for availing Letter of credit facility and/or buyers credit facility for the import of second hand capital goods? Is it possible for a company to avail these facilities for second hand machinery?

Continue reading Buyers Credit on Import of Second Hand Machinery →

18.436385

82.738182

Using Swift Codes Banks and Financial Institutions send and receive swift messages. But there must have been times where you might have come across your bankers coming back to you stating that they do not have swift key arrangement with buyers credit bank. Thus they will not be able to send Letter of Undertaking (LOU) / Letter of Comfort (LOC) authenticated swift message (MT799) to buyers credit bank. Below article gives a brief about why situation arise.

Continue reading Relationship Management Application (RMA) and Buyers Credit →

18.436385

82.738182

Importers banking with Co operative Bank’s both AD Category and Non AD Category, face issues with arranging buyers credit because

- In case of AD Category Co operative Bank: Limited Lines in International Market or No Lines

- Non AD Category Co operative Bank: They cannot deal directly in Import or Export transaction but have to route the transaction through tie up bank.

Continue reading Buyers Credit for Co Operative Bank Customers →

18.436385

82.738182

In the circular issued on 11th July 2013, RBI has made following two changes in relation to Trade Credit transactions:

- Period of Trade Credit (Buyers Credit / Suppliers Credit) should be linked to the operating cycle and trade transaction.

- All in cost ceiling of 6 Month L+ 350 bps will continue to be applicable till September 30, 2013 and is subject to review thereafter.

Continue reading Period of Buyers Credit Linked to Operating Cycle →

In earlier articles, we had seen that, banks are permitted by RBI to approve Suppliers’ and Buyers’ Credit (Trade Credit) including the usance period of Letters of Credit opened for Import of gold in any form including jewelery made of gold/ precious metal and or studded with diamonds /semi precious /precious stone not exceeding 90 days from the date of shipment.

Continue reading Buyers Credit on Import of Precious and Semi Precious Stone →

18.436385

82.738182

Myanmar has been under various international economic sanction for more than a decade, which has crippled its international trade. Below article gives a background of economic sanctions on Myanmar, recent relaxations in these sanctions and what will be its likely impact on trade finance from Indian importers perspective.

Continue reading Myanmar Economic Sanctions – Background, Recent Relaxation & Trade Finance →

18.436385

82.738182

What is High Sea Sales ?

High Sea Sales (HSS) is a sale carried out by the carrier document consignee to another buyer while the goods are yet on high seas or after their dispatch from the port/airport of origin and before their arrival at the port/ airport of destination.

Continue reading Buyers Credit on High Sea Sales Transaction →

18.436385

82.738182

In earlier article we had discussed about WHT on Buyers credit. This article answers questions related to withholding tax on suppliers credit.

Continue reading Withholding Tax (WHT) on Suppliers Credit Transactions →

18.436385

82.738182

Note: Post this article there are changes in maturities for which libor is issued. This article might now be relevant for long tenure transactions (12 Months and Above). Refer link for more details on change in Libor: Change in LIBOR Tenures and Impact on Trade Finance

Banks and Importers consider various factors before going for Buyers Credit transaction for more than 6 months tenure. One such factor is buyers credit with 6 Month Libor Reset option. The below article elaborates on these factors.

Continue reading Buyers Credit with 6 Month Libor Reset →

18.436385

82.738182

After the expiry of deadline of 30-09-2012, there was a prolonged uncertainty for last 9 days on what is the all in cost ceiling for Trade Credit (Buyers Credit / Suppliers Credit). Reserve Bank of India (RBI) issued a clarification or revised circular today clarifying the same. Summary of the same is given below

- Maximum Interest cap for Upto 5 Years : 6 Month Libor + 350 bps. This rate has been referred in it circular 11-09-2012 (Link given below)

- Until further review, the rate remains same. Thus, this time there is no deadline set for the review of the above rate to avoid any slippage like above.

Continue reading Review of Trade Credit All-In-Cost Ceiling →

18.436385

82.738182

In earlier articles on Buyers Credit on Import of Gold and Import of Platinum, Palladium, Rhodium, Silver, as stated, Reserve Bank of India (RBI) had permitted banks to approve Suppliers and Buyers Credit (Trade Credit) including the usance period of Letters of Credit for import of rough, cut and polished diamonds, for a period not exceeding 90 days, from the date of shipment.

Continue reading Buyers Credit on Jewellery →

18.436385

82.738182

From Importer’s Perspective

There are various reasons because of which an importer would like to make a pre-payment of buyers credit. Such as:

- USD-INR rate in favour of importer post buyers credit is taken.

- Buyers credit is taken by way of keeping Fixed deposit as security and now importer wishes to free cash.

- Importer wishes to free Non Funds based limits for other use.

- Any other such reasons.

Continue reading Prepayment of Buyers Credit →

18.436385

82.738182

EURO based buyers credit is currently funded by most of the banks using EURIBOR which is issued by European Banking Federation and ACI. A similar rate is issued by British Banking Association known as EUR Libor but is not often used by bankers for funding buyers credit transactions.

Continue reading Difference Between EURIBOR & EUR Libor →

18.436385

82.738182

What is OFAC Sanctions ?

- The Office of Foreign Assets Control (OFAC) is an office of the Treasury Department of United States of America (US).

- OFAC administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against targeted foreign countries, organizations, entities, and individuals.

- Regulations issued under Trading With the Enemy Act (50 U.S.C. App.§§ 1-44) or by the US President under authority delegated under the International Emergency Economic Powers Act.

- The OFAC sanctions programs are implemented through restrictions on imports and exports, prohibitions on financial transactions, freezing of assets, and other means.

Continue reading OFAC Countries & Implication on Buyers Credit →

18.436385

82.738182

Considering the specific needs of the Infrastructure sector, RBI under its circular External Commercial Borrowing (ECB) – Bridge Finance for Infrastructure Dated 23-09-2011, reviewed the ECB policy. An amendment was made in this policy on 21-09-2012. Brief summary is given below:

Continue reading Infrastructure Companies – Bridge Finance before availing ECB →

18.436385

82.738182

Change in LIBOR Tenures and Impact on Trade Finance

Earlier articles on Buyer’s Credit have provided details on total cost involved like, Interest cost, libor, lou charges, forwarding booking cost, arrangement fee, and others.

This article provides details on how interest cost (margin) is arrived at by Indian Bank Overseas Branches or Foreign Bank.

Continue reading Buyers Credit Interest Rate (LIBOR + Margin) →

18.436385

82.738182

Type of Transaction Where Buyer’s Credit Cannot be Done

- Incase of local trade

- Advance payment for Imports: Buyers Credit for any amount paid as advance either part or full is not allowed as RBI Caster Circular on External Commercial Borrowing and Trade Credit. Inference has to drawn the above circular. Circular says maximum tenure allowed for buyers credit from the date of shipment is (shipped on board date) upto 360 days in case of raw material and upto 3 years in case capital goods. Any Advance Payment always done before shipment of goods. And thus not allowed.

- Not allowed for import of services

Continue reading Transaction where Buyer’s Credit is Restricted →

18.436385

82.738182

Reserve Bank of India (RBI) in its circular dated 28-08-2008 had revised guidelines for Import of Platinum, Palladium, Rhodium and Silver. Extracts of the circular are given below.

Suppliers’ and Buyers’ credit, including the usance period of Letters of Credit opened for import of Platinum, Palladium, Rhodium and Silver should not exceed 90 days from the date of shipment. The revised directions will come into force with immediate effect.

Continue reading Import of Platinum, Palladium, Rhodium, Silver →

20.593684

78.962880

Reserve Bank of India (RBI) in its circular dated 06-05-2011 has revised guidelines for import of Rough, Cut and Polished Diamonds. Extracts are given below.

Supplier’s Credit and Buyer’s Credit (Trade Credit) including the usance period of Letter of Credit (LC) opened for import of rough, cut and polished diamonds has been restricted to 90 days from the date of shipment from immediate effect.

Continue reading Buyer’s / Supplier’s Credit on Rough, Cut and Polished Diamonds →

20.593684

78.962880

Person / Firm who co ordinates with Indian Overseas Branches or Foreign Bank and arranges best possible quote for transactions. They do not directly represent any of these bank. They are also known as Buyers Credit Brokers & Buyers Credit Agents

Continue reading Buyers Credit and Suppliers Credit Consultants →

20.593684

78.962880

| Criteria |

Buyers Credit |

Suppliers Credit |

| Mode of Payment |

Can be used for payment mode like LC, LC usance, DA, DP, & Direct Doc |

Can be used only in case of LC transactions |

| LC Clauses |

No additional clauses or Amendment is required in LC |

At the time of opening LC or amending LC clauses given by Suppliers Credit bank needs to be changed. Like Negotiation Clause, Confirmation Clause, Reimbursement Clause |

| Arrangement |

Can be arranged after documents have reached the bank or documents are received by importer directly |

Has to be arranged at the time of opening LC or before shipment of goods |

| Cost |

Interest Cost |

LC Advising Cost, LC Amendment Charges, Document Processing Charges, Courier Charges, Conformation Cost and Interest Cost |

20.593684

78.962880

What is Supplier’s Credit ?

Supplier’s Credit is a structure of financing import into India. In this structure, overseas suppliers or financial institutions outside India provide financing to importer on Libor linked rates against usance letter of credit (LC).

Continue reading Supplier’s Credit – Meaning & Process →

20.593684

78.962880

New Article: RBI Circular : Trade Credit – New Regulatory Framework

Updated on 19 October 2016

Trade Credits refer to the credits extended by the overseas supplier, bank and financial institution for maturity up to five years for imports into India. Depending on the source of finance, such trade credits include suppliers’ credit or buyers’ credit. Suppliers’ credit relates to the credit for imports into India extended by the overseas supplier, while buyers’ credit refers to loans for payment of imports into India arranged by the importer from overseas bank or financial institution. Imports should be as permissible under the extant Foreign Trade Policy of the Director General of Foreign Trade (DGFT).

Continue reading RBI Trade Credit (Buyers/Suppliers Credit) Circular Extract →

20.593684

78.962880

Meaning, Process, Quote, Interest Rate, SBLC, RBI & More