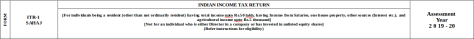

Income Tax Return Form – ITR-1 (Sahaj) is applicable to only Resident Individuals having total income upto Rs. 50 lakhs, having Incomes from Salaries or Pension, One House property, Other sources (Interest etc.), and agricultural income upto Rs.5,000.

The new ITR-1 form is not applicable to:

- Non-residents and Residents but not ordinarily resident (RNOR)

- An individual who is either Director in a company or has invested in unlisted equity shares

The major changes in ITR-1 for the Assessment year 2019-20; Financial year 2018-19 are as below:

1. Income from Salary/Pension – Item No. 1:

In the new form disclosure is required as per Form 16 under below heads:

A. Gross Salary

-

- Salary as per section 17(1)

- Value of perquisites as per section 17(2)

- Profits in lieu of salary as per section 17(3)

B. Less : Allowances to the extent exempt u/s 10 (included in salary income above). Select from the list given for Nature of Exempt allowance. Provide Description If ‘Any Other’ is selected for Exempt Allowance.

C. Deduction u/s 16

- Standard Deduction u/s 16(ia)

- Entertainment Allowance u/s 16(ii)

- Professional Tax u/s 16(iii)

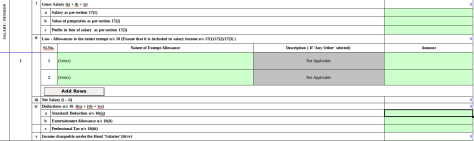

2. New Insertion – Item No. 2 vi :

Arrears/Unrealized Rent received during the year Less 30% under Income from House Property.

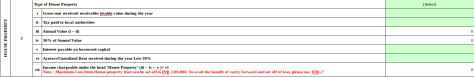

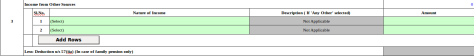

3. Income from Other Sources – Item No. 3:

Earlier only amount under Income from Other Sources was required to be furnished, now specific details under below heads are required:

- Nature of Income from the list provided below is to be selected and amount is to be mentioned.

- Interest from Saving Account

- Interest from Deposit (Bank / Post Office / Co operative Society)

- Interest from Income Tax Refund

- Family Pension

- Any Other

- Description is to be given If ‘Any Other’ is selected. For Example Tailoring income.

- In case the nature of other sources income is selected as Family pension then a new row has been inserted as :

- Less: Deduction u/s 57(iia) (In case of family pension only). Kindly note this is a system calculated amount.

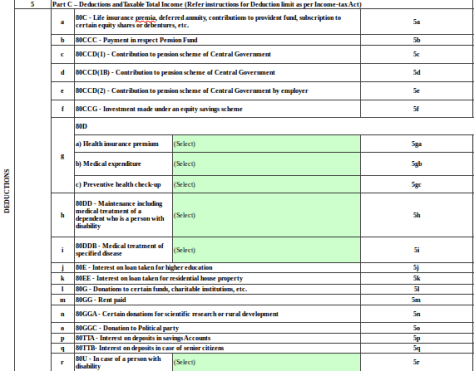

4. Part C – Deductions and Taxable Total Income – Item No. 5:

Headings of Various deduction sections from 80C to 80U has been clearly specified.

- Section 80D has been further sub classified under:

- a) Health insurance premium – Maximum limit Rs. 1,00,000.

- b) Medical expenditure – Maximum limit Rs. 1,00,000.

- c) Preventive health check-up – Maximum limit Rs. 5,000.

- Section 80DDB – Medical treatment of specified disease :

- Self or dependent – Maximum limit Rs. 40,000.

- Self or dependent-Senior Citizen – Maximum limit Rs. 1,00,000.

- Section 80QQB – Royalty income of authors of certain books has been removed.

- Section 80RRB – Royalty on patents has been removed.

- Section 80TTA – has been changed to Interest on deposits in savings Accounts from Income from Interest on saving bank Accounts.

- New Section 80TTB – Interest on deposits in case of senior citizens has been inserted – Item no. 5q : Deduction shall be allowed from amount in “Income from Other Sources”

5. Exempt Income for Reporting Purpose:

It has been moved to Income Details Sheet from Taxes Paid and Verification Sheet Item no. 27.

It has also specified the list of Nature of Income to be selected from exempt income under section 10, Agricultural Income, Defense Medical Disability Pension and Any other.

6. Health and Education Cess – Item No 11:

Health and Education Cess @ 4% on Tax Payable after Rebate

7. Fee u/s 234F – Item No. 15d:

- Cases where the total income is less than Rs 2.5 lakhs, there is no late filing fee.

- Cases where the total income is above 2.5 lakhs but less than Rs 5 lakhs, late filing fee is Rs 1,000.

- Cases where the total income is Rs 5 lakhs and above, if the income tax return is filed after the due date (July 31, 2019) but on or before the December 31, 2019, there will be late filing fee of Rs 5,000.

- Cases where the total income is Rs 5 lakhs and above, if the return is filed after December 31, 2019 but on or before the March 31, 2020, there will be late filing fee of Rs 10,000.

- After March 31, 2020 the returns cannot be filed.

8. Details of Tax Deducted at Source:

Item No. 19 TDS2 Details of Tax Deducted at Source from Income OTHER THAN Salary [As per FORM 16 A issued by Deductor(s)] and Item No. 20 TDS3 Details of Tax Deducted at Source [As per Form 16C furnished by the Payer(s)] :

- Column (3) Gross receipt which is subject to tax deduction is to be provided in place of Amount which is subject to tax deduction.

- Column (6) TDS Credit out of (5) claimed this Year is to be provided in place of Amount out of (column 5) claimed this Year – It means out of the total tax deducted for the relevant year, how much is to be claimed in this assessment year. The remaining amount is allowed to be carried forward in future years. For example TDS deducted in FY 2018-19 is Rs. 200 and claimed in this year is Rs. 150, then amount in column 5 will be Rs. 200 and column 6 will be Rs. 150. Hence remaining Rs. 50 will be allowed to carried forward in next year.

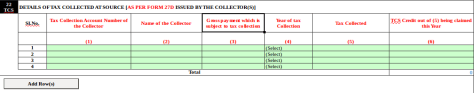

9. Details of Tax Collected at Source:

Item No. 22 TCS : Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)] : Column (3) Gross payment which is subject to tax collection is to be provided in place of Amount which is subject to tax collection. Column (6) TCS Credit out of (column 5) being claimed this Year is to be provided in place of Amount out of (column 5) being claimed this Year.

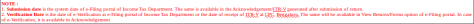

10. Verification:

- System Date will automatically get picked in Date column.

- Difference of Submission Date and Verification Date

Submission Date is available in the ITR-V / Acknowledgement generated after submission of return. Verification date is the date of Receipt of ITR -V at CPC. In case of e-verification, it is available in the Acknowledgement.

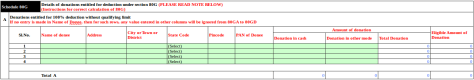

11. Schedule 80G:

Amount of Donation is to be shown separately as Donation in cash and Donation in other mode = Total Donation

12. New Insertion – Schedule 80GGA:

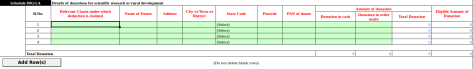

Details of donations for scientific research or rural development is newly inserted in ITR 1 Sahaj

What term to enter in TDS2 in column 3 (Gross receipt which is subject to tax deduction)?

Gross receipt which is subject to tax deduction means the total amount received on which Tax is deducted at source. The same is available under the head Total Amount Paid /Credited in 26AS.

In TDS 2 in column 3, you should enter the gross amount of income received before TDS. Income such as Interest Income from Bank, Sale of Assets, Commission Income etc.